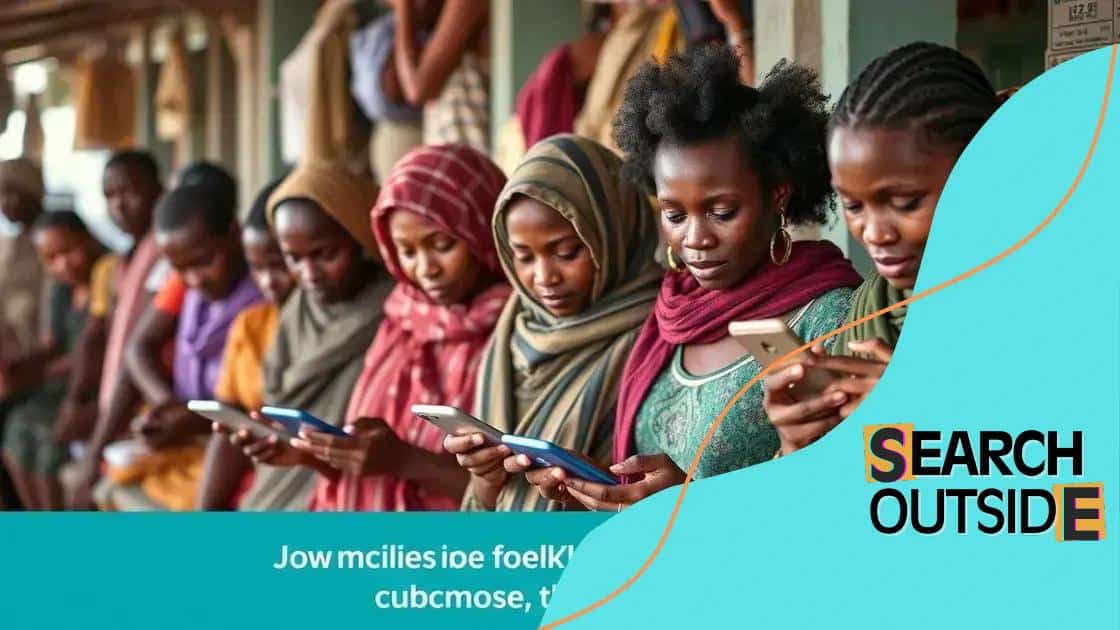

How mobile banking is increasing financial inclusion

Mobile banking significantly increases financial inclusion by providing access to essential banking services for unbanked populations, enhancing convenience, security, and user engagement with financial products.

How mobile banking is increasing financial inclusion is not just a trend; it’s a transformative shift in how financial services reach people. Have you noticed how easy it is to handle finances from your phone? Let’s dive into this evolving landscape.

Understanding mobile banking

Mobile banking has become a vital tool for many people around the world. It’s reshaping how we manage our money and access financial services. By enabling transactions through devices like smartphones, mobile banking makes banking more accessible than ever.

Understanding mobile banking is essential for grasping its impact on financial inclusion. Unlike traditional banking, where a physical presence is often required, mobile banking allows users to perform various financial tasks anytime and anywhere.

How Mobile Banking Works

Mobile banking applications leverage the internet to connect users to their banks. Users can open accounts, transfer money, pay bills, and more with just a few taps on their screens.

- Transfer funds quickly and securely

- Access account information in real-time

- Pay bills without visiting a bank

- Receive notifications for transactions

This convenience greatly enhances the banking experience. Additionally, mobile banking often comes with features that promote financial literacy, helping users make informed decisions about their finances.

Benefits of Mobile Banking

Using mobile banking can lead to greater financial inclusion. Here are some key benefits:

- Accessibility for unbanked populations

- Reduced costs in managing finances

- Increased savings rates through easier access to funds

By utilizing mobile banking, underserved communities can bypass traditional barriers, such as proximity to physical banks and high fees. This shift empowers individuals and fosters a more inclusive financial environment.

Moreover, advancements in technology, such as biometric security, enhance user confidence in mobile banking, ensuring that people feel secure when managing their money on their devices.

The role of mobile banking in accessibility

The role of mobile banking in accessibility is transforming the way individuals interact with financial services. With just a smartphone, people can access a variety of banking functions without needing to visit a physical bank branch.

Many users appreciate the convenience mobile banking offers, especially in areas where traditional banking institutions are scarce. This service enables people to manage their finances, pay bills, and transfer money quickly and easily.

Enhancing Financial Access

Mobile banking plays a crucial role in enhancing financial access for various demographics, including the unbanked and underbanked. It’s important to understand how its features contribute to greater financial equality.

- Eliminates the need for physical bank branches

- Offers services 24/7, allowing anytime access

- Reduces travel costs and time for customers

- Provides options for individuals without credit histories

Through mobile banking, many people can finally access services that were previously out of reach. This technology encourages users to take control of their financial lives, promoting responsibility and improving overall money management skills.

Bridging the Gap

In many rural or isolated areas, mobile banking is a game changer. It bridges the gap between urban and rural banking services. People living in remote locations can conduct transactions without the hassle of long journeys.

This improves their ability to save, spend, and invest. Moreover, with easy access to financial education resources within mobile banking apps, users can learn about financial planning, budgeting, and investing right from their devices. This empowers them to make informed decisions and work towards their financial goals.

Case studies of financial inclusion through mobile banking

Case studies of financial inclusion through mobile banking provide valuable insights into how technology can empower individuals and communities. Real-world examples showcase the effectiveness of mobile banking in bringing financial services to underserved populations.

One notable case is M-Pesa in Kenya. This mobile payment platform has transformed how people conduct transactions. With over 40 million users, M-Pesa lets individuals send and receive money through their mobile phones, significantly improving access to financial services.

Impact of M-Pesa

The impact of M-Pesa is profound. People can now easily pay for goods, transfer funds to family members, and even save money. This service has led to an increase in household savings and improved economic stability.

- Over 1 million businesses accept M-Pesa payments.

- It has reduced the need for cash, increasing safety.

- It allows users to access credit through mobile platforms.

Another example is GCash in the Philippines, which has also played a significant role in reaching individuals without traditional banking access. Users can perform various transactions such as bill payments and money transfers instantly.

Benefits of GCash

GCash has demonstrated similar benefits to M-Pesa. It opened up the financial system to many who previously faced barriers. By enabling users to control their finances directly from their smartphones, GCash promotes financial literacy and empowerment.

The integration of mobile banking with local businesses has boosted community economies, proving that technology can bridge gaps and create opportunities. As these case studies show, the success of mobile banking can lead to significant advancements in financial inclusion, changing lives for the better.

Challenges faced in mobile banking adoption

Challenges faced in mobile banking adoption can hinder the full potential of this transformative technology. Despite its numerous benefits, many individuals still encounter obstacles when trying to access mobile banking services.

One significant challenge is the lack of digital literacy. Many potential users do not know how to use mobile banking apps effectively, which can lead to distrust and reluctance to embrace this technology. Without proper education and support, these individuals may miss out on the advantages that mobile banking offers.

Security Concerns

Security is another critical issue affecting mobile banking adoption. Users often worry about the safety of their personal and financial information.

- Phishing attacks can compromise account security.

- Data breaches may expose sensitive information.

- Lack of awareness about mobile security best practices increases risk.

These fears can prevent users from engaging with mobile banking services, as they may feel more comfortable with traditional banking methods that seem more secure to them.

Network Connectivity

Network connectivity also poses a challenge, especially in rural and underserved areas. Many people depend on reliable internet access to use mobile banking.

In regions with poor network infrastructure, users may experience interruptions while trying to perform transactions. This can lead to frustration, causing them to abandon mobile banking entirely. Additionally, high data costs can be a barrier for users with limited financial means.

Moreover, some banks may not offer comprehensive support for mobile banking, limiting the functionality of their apps. If users cannot access essential features, they may become discouraged and seek out other options, further impeding adoption. Addressing these challenges is crucial for enhancing the overall mobile banking experience.

Future trends in mobile banking and finance

Future trends in mobile banking and finance show how technology continues to evolve, bringing about significant changes in how we handle our money. As mobile banking becomes more mainstream, several trends are emerging that will shape the financial landscape.

One significant trend is the rise of artificial intelligence (AI) in banking applications. AI enhances customer service by providing personalized insights and assistance. For example, chatbots can help users manage accounts, answer questions, and offer financial advice in real-time.

Increased Use of Biometric Security

Security features are also evolving, with more banks implementing biometric technology for user authentication. This includes fingerprint scans and facial recognition. Such measures increase security, giving users confidence to engage with financial services.

- Biometric security improves fraud prevention.

- It streamlines the login process for users.

- Facial recognition can add a layer of convenience.

Another notable trend is the integration of blockchain technology in mobile banking. Blockchain can enhance transaction security and allow for faster, more transparent record-keeping. Users can make transactions without relying on a central authority, offering greater control over their finances.

Growth of Digital Wallets

Digital wallets are also gaining popularity, allowing users to store payment information and make purchases seamlessly. Many mobile banking applications now offer digital wallet features that facilitate easy payments.

This shift not only simplifies transactions but also encourages cashless economies, especially in developing regions. As digital payment solutions increase, more individuals will access financial services, furthering financial inclusion.

Lastly, the focus on financial education within mobile banking apps is likely to grow. By integrating educational resources, banks can empower users to make informed financial decisions, helping them manage their money better.

FAQ – Frequently Asked Questions about Mobile Banking and Financial Inclusion

What is mobile banking?

Mobile banking allows users to access financial services through their smartphones, enabling transactions, payments, and account management anytime and anywhere.

How does mobile banking enhance financial inclusion?

Mobile banking provides access to financial services for unbanked populations, allowing them to manage their finances and participate in the economy without needing traditional bank branches.

What are some challenges to mobile banking adoption?

Challenges include lack of digital literacy, security concerns, and limited network connectivity in rural areas, which can hinder user engagement with mobile banking services.

What future trends can we expect in mobile banking?

Future trends include increased use of artificial intelligence for personalized services, enhanced biometric security for safer transactions, and the growing popularity of digital wallets.